The 5-Minute Rule for Two 10

Wiki Article

More About Two 10

Table of ContentsTwo 10 Fundamentals ExplainedThe Basic Principles Of Two 10 An Unbiased View of Two 10The 7-Minute Rule for Two 10The 3-Minute Rule for Two 10Two 10 Things To Know Before You Buy

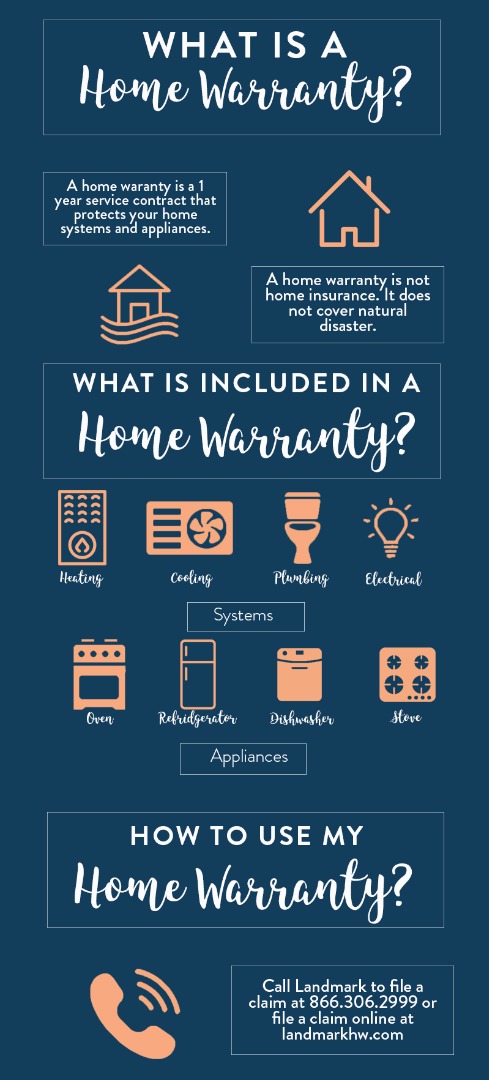

For many individuals, a residence service warranty makes sense. It makes sure that you can get products in your house repaired or changed and gives a supplement to your home owners insurance coverage. As you're choosing to purchase a service warranty, it's a practical concept to do a homeowners insurance policy examination. Find out about the various kinds of insurance policy as well as degrees of protection to ensure your needs are satisfied and you have tranquility of mind.The service warranty assures to the house owner that if something that is covered by the residence warranty strategy stops functioning or breaks down after that it will be repaired or changed by the service warranty company, based on the terms and problems of the agreement. A residence protection plan typically covers mechanical failures or break downs as a result of normal damage of your home devices or significant systems (heat/air conditioning, pipes, electrical, kitchen devices, etc) depending upon the strategy as well as choices that you pick (two 10).

Costs paid to the underwriter for home warranties are 'reserved' in accounts for future losses.

The Definitive Guide for Two 10

There are 2 types of licenses, administration licenses and also obligor licenses in the United States. A sector of states require registration to be acknowledged as a residence service warranty administrator. Those states are presently: CA, CO, FL, IA, LA, NC, OKAY and also VA. Again, the obligor is on the hook for paying for services guaranteed.

Those states are presently: CA, CO, FL, IA, LA, NC, OKAY and also VA. Again, the obligor is on the hook for paying for services guaranteed.Not known Factual Statements About Two 10

What does underwriting suggest relevant to OEM service warranties as well as service contracts? OEMs have to establish apart a book or fund to cover the expenses of anticipated or approximated service warranty repair service expenses. Owning a home can be a risky endeavor, taking into consideration all the potential risks. From intruders and hail storms to a heater that suddenly damages down in the center of winter season, there's a great deal that can happen to your house. Luckily, you have choices when you need a financial safeguard.

Owning a home can be a risky endeavor, taking into consideration all the potential risks. From intruders and hail storms to a heater that suddenly damages down in the center of winter season, there's a great deal that can happen to your house. Luckily, you have choices when you need a financial safeguard.It's vital to comprehend the differences in between them and when it makes feeling to choose both types of plans. What does house owners insurance coverage cover? A. As an example, fire, theft, numerous kinds of natural disasters, disaster, vandalism, crashes as well as various other risks are usually included in a homeowners insurance plan.

How Two 10 can Save You Time, Stress, and Money.

House owners service warranty insurance coverage is purely and not needed by your home loan lending institution or anyone else. Property owners insurance coverage is indicated to shield insurance policy holders versus damage to their personal residential property and damage to the home's structure, while home warranties cover mechanical equipment that requires to be fixed or changed.Claim a pipeline bursts in your home. Your residence guarantee would cover the prices to fix the pipe yet not damage caused by the leakage.

Here's an introduction on what a home service warranty is, exactly how much it costs and if it deserves it. What is click to read a house warranty? A house warranty is not an insurance coverage policy, yet instead a service agreement that pays the cost of repair work or substitute of covered things, such as major kitchen appliances, along with electrical, pipes, heating as well as air conditioning systems.

Some Ideas on Two 10 You Need To Know

She also suggests them to buyers."It depends upon what I hear my customers saying their possible discomfort point is," Smith says. "What is their issue or suffering regarding a home? Someone might say, 'I love this residence except it gets on private systems, like a septic system or a well, and also I do why not try this out not want to handle it if it breaks.'"Remember that representatives occasionally recommend home warranties merely due to the fact that they are partnered with the company you're under no commitment to buy one.You can picture much more if you want improved protection for such points as washing machines and clothes dryers, swimming pools and also septic tanks. In enhancement to the yearly costs, expect to pay a fee for solution telephone calls, anywhere from $60 to $100, relying on your provider and the sort of contract you acquire (two 10).

Ask the service provider what your repayment responsibility would be if something can not be repaired. Eventually, you have to make a decision if the tranquility of mind matters extra than the expense. Who should acquire a house guarantee?

A Biased View of Two 10

Residence vendors could likewise wish to take into consideration supplying a home warranty to buyers to sweeten the bargain. In the occasion a major home appliance unexpectedly stops working, it can be repaired or replaced at little price, which a brand-new purchaser will appreciate. As the customer, constantly ask the seller what home appliances or systems are currently under warranty, and obtain the documentation concerning the plan so you can transfer it to you and also recognize when the protection finishes.

When to miss a house service warranty, It's not beneficial to acquire a residence guarantee for a freshly built house since you'll end up with replicate coverage. Buyers that buy brand-new construction generally obtain some kind of service warranty from the building contractor for the residence's products and workmanship consisting of find here pipes, electrical, heating and also cooling systems for one, 2 or as much as 10 years.

Report this wiki page